If you need to set up Multi-Rate Tax print this topic and replace the sample data shown in the table below with your own. The sample data in the form is from our tutorial called Understand Multi-Rate Tax.

Tax Rate Codes |

||

#1 Who gets taxed? |

#2 What Gets Taxed? |

How Much? |

Minnesota |

General Merchandise |

6.5 |

Minnesota |

Liquor |

9.0 |

Rochester |

General Merchandise |

7.0 |

Rochester |

Liquor |

9.0 |

|

|

|

|

|

|

Tax Locales (each unique value from column one above) |

||

Minnesota |

||

Rochester |

||

|

||

|

||

Tax Class Codes (each unique value from column two above) |

||

General Merchandise |

||

Liquor |

||

Cigarettes |

||

|

||

|

||

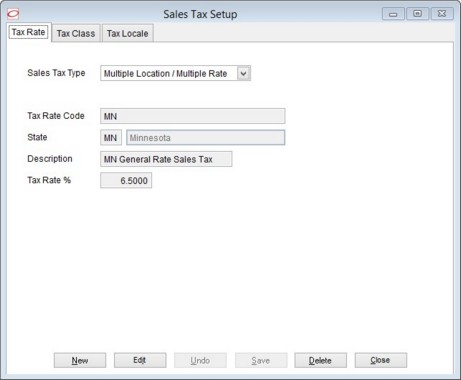

•In Acme, click >Maintenance >Sales Tax Setup >Edit button,

Set Sales Tax Type to Multiple Location / Multiple Rate.

•Click the Tax Class tab and enter each of your Tax Classes.

•Click the Tax Locale tab and enter a Tax Location on the top of the screen and EACH related Sales Tax Class on the bottom of the screen.

•Repeat previous step for each combination of Local/Class

"Close" when finished entering your Tax Locales.

1.if you haven't already, set up your walk-in (cash) customer by clicking >Customer >Customer. Ensure the customer is NOT set up as Tax Exempt.

2.Set up at least one identified (named) customer (e.g. Nick M Shavin) with a Alternate (delivery) Address. Enter appropriate Tax Location on address.

3.Click >Maintenance >POS Terminal Setup and ensure the Walk-In Tax Locations Code (see more info below) is set to the location where your store is located AND set "Default Customer Code" to match the walk-in customer you entered above.

4.Set up a taxable item for each tax class. For example, if you sell candy and liquor then enter at least two items, one that is a candy and one that is liquor.

5.Test the sales tax setup from within Ticket Entry using the following scenarios:

•Walk in customer and taxable item. -should be taxed at the "store's" rate.

•Walk in customer and taxable items from more than one class. -should be taxed at the "store's" rate for each item.

•Identified customer, purchase in store. -should be taxed at the store's rate.

•Identified customer, flagged for delivery to locale with different tax rate. -should be taxed at the other locale's tax rate.

•Walk customer, flag for delivery, pick a location with different rate. -should be taxed at the other locale's tax rate.

All customers will be taxed at the rate of the Walk In Tax Location Code unless the

Walk-In Tax Location Code -more info

Choose the tax location code that all transactions will default to unless the transaction is flagged for delivery. If a ticket is flagged for delivery the tax location code associated with the delivery address will be used.

If this is left blank the sales tax location from the Default Customer (see above) will be used.